Estate Planning

If you are like most people starting the estate planning process, you probably don’t have a full understanding of what is involved. Common questions include:

- What do I need to bring to the initial meeting?

- How much will the estate plan cost?

- What type of estate plan do I need?

- How long does it take to complete the estate planning process?

- What do I have to do after my estate plan is created?

We will answer these common questions and more below.

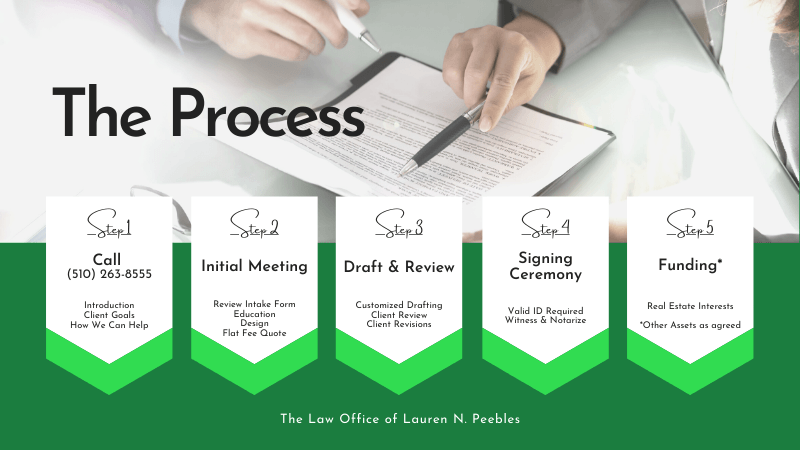

THE INITIAL CALL TO OUR OFFICE – THE HARDEST PART!

Most of the time, the hardest part of the estate planning process is taking the initiative to get started. Whether you were referred by an existing client, another professional or found us online, the hardest part is just getting started. We understand. It’s not something that seems overly enjoyable, but, it can be with our step by step process.

Our initial call is designed to accomplish a few things:

- Gives us an opportunity to introduce ourselves;

- Understand your general goals;

- Confirm if we can be of assistance; and

- Find a good time to meet to discuss further.

YOUR HOMEWORK BEFORE THE ESTATE PLANNING MEETING

Once we’ve confirmed that we can be of assistance, we’ll email you an intake form. The purpose of the intake form is to obtain some of the key information about you, your family, and your estate, so that we can maximize our time together during our first meeting. We will also confirm your appointment with our office and your meeting time.

Your intake form helps us prepare for your Estate Planning Meeting. Therefore, it is critical you complete the form at least 1-2 days before your scheduled Estate Planning Meeting. If your intake form is not completed before your meeting, we will contact you to reschedule your appointment.

THE ESTATE PLANNING MEETING

During our time together at your Estate Planning Meeting, we will review the information provided on your form. However, experienced lawyers understand that any attempt to outline the specifics of each estate planning meeting would be virtually impossible. While each Estate Planning Meeting is different and unique, these meetings are designed to have a flow. The basic structure to most estate planning meetings includes:

- Going through your intake form to better understand who you are, beyond what is written on paper;

- Explaining estate planning concepts and how those concepts are applicable to you, generally;

- Design your specific estate plan by discussing the pros and cons of various options;

- Confirm your flat fee quote for the estate plan design you have chosen (*note: our basic fee structure can be found on our website); and

- Decide if you want to move forward with our services to draft your estate plan and pay your initial deposit (1/2 of your flat fee charges).

ESTATE PLANNING DRAFTING

Pre-Drafting Week

The time it takes for us to complete an estate plan varies. However, generally, it will take us approximately 4 – 6 weeks to draft your estate plan once your intake form is complete and we’ve held your Estate Planning Meeting. Why 4 – 6 weeks?

Recall that during our Estate Planning Meeting, we discuss your specific estate plan by discussing the pros and cons of various options. In our experience, some clients need a bit more time to think about the pros and cons before making a final decision. With the rich information provided to clients during our Estate Planning Meeting, sometimes ideas for the structure of the plans change. Therefore, following your Estate Planning Meeting, you are given one full week to think further about our discussion (Pre-Drafting Week) and to advise if any changes are necessary or make final decisions on any pending issues from our initial estate planning meeting before we begin drafting. And, if you do not have any changes during your Pre-Drafting Week, there is nothing further required on your end. If we do not hear from you with any changes during your Pre-Drafting Week, we will begin.

Drafting

As your drafts are completed, they are uploaded to your online client account so that you can view the drafts in real time! In addition, we prepare additional helpful documents for your plan such as Memorial Instructions forms, Instructions for your trustee, and Trust Funding Instructions.

REVIEWING DRAFTS

After uploading your estate plan draft documents, you have the opportunity to review the documents to ensure they express your wishes properly. You can then contact our office to schedule your Final Review Meeting. During the Final Review, we will go through each document in detail with you and answer any questions you have about the language. Once your review is complete, we package your plan with signature stickers and mail to you (certified or FedEx for tracking) with instructions for the next step…your signing!

SIGNING CEREMONY

It is now time to sign! You have reviewed the estate plan, made any final adjustments, and are ready to sign the estate planning documents. Unfortunately, following the COVID-19 global pandemic, we stopped hosting Signing Ceremonies in our office. You will need to contact a notary commissioned in your area to assist you with executing your documents, but we provide you (and your notary) with very clear instructions for how to do this important step.

FUNDING YOUR TRUST

Just when you thought you were done, in comes the most important part of estate planning, trust funding. We will discuss this concept in detail during your Estate Planning Meeting, but essentially once your Trust is executed, we need to transfer your assets to your Trust. This final step is extremely important because, without proper trust funding, your estate plan will be ineffective. One of the many differences between our firm and other attorneys or online software is that we assist you with transferring your real estate assets to your Trust. If you own real estate, included in your Estate Plan will be a Trust Transfer Deed. Once your Trust Transfer Deed is signed and notarized, you will then mail back to our office and we will take care of the rest!

COMPLETE

And just like that, you now have a comprehensive Estate Plan that will protect you and your family for generations. Once your Trust Transfer Deed is recorded and returned to you, the process is complete. But our relationship will not end. You may need to make changes in the future or have questions as your circumstances change. We recommend clients review their estate plan every tax season to ensure it adequately reflects their current wishes.

If you have any questions about our process or simply wish to talk further about estate planning, please call us at (510) 263-8555 or email info@thepeebleslawyer.com or book an appointment directly with our Book an Appointment feature found at the top of this page.